Partner content in association with

Nomura builds capabilities to connect Asia to the world

Kenji Teshima, CEO of Nomura Asia Pacific Holdings

As Asia’s global investment bank, Nomura has built on its traditional strengths of connectivity into Japan, a solid global markets business in Asia ex-Japan, and select areas of regional dominance within investment banking, such as advising on kangaroo bond issuances or initial public offerings in India.

At the same time, the Tokyo-headquartered global financial services group with a rich history of almost 100 years has continuously expanded into newer areas including tapping private markets, redoubling efforts to bank high net-worth individuals, building its onshore China business, driving sustainability and embracing digitalization.

“With an integrated network across Asia ex-Japan, we are in a unique position to find creative solutions for our clients with an astute understanding of the risks involved,” said Kenji Teshima, CEO of Nomura Asia Pacific Holdings, the primary holding company for the fi rm’s businesses in Asia. “Our experience navigating Asia is unrivaled. We are deeply rooted in this region, enabling us to operate globally and seamlessly across borders.”

Global Markets Strengths

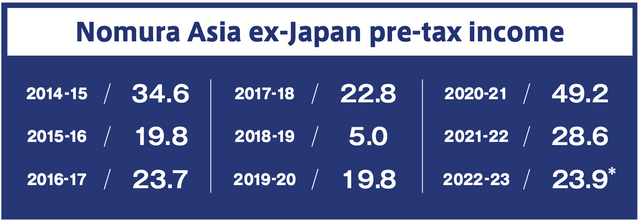

Nomura’s global markets business in Asia ex-Japan remains the bedrock of the regional franchise, underpinning eight consecutive years of pretax profits in the region, and on track for a ninth year.

Within global markets, the global FX and emerging markets business run out of Singapore has been in expansion mode, bringing in new talent and infrastructure as Nomura hopes to capture market share in emerging markets and G10 FX trading.

Its flow credit business, primarily run from Hong Kong, continues to fire on all cylinders, ranking No. 2 by revenue share in Asia ex-Japan in a competitor analysis done by Coalition Greenwich for the fi rst half of 2022. Based on a poll of institutional investors, Wentao Yan, one of the bank’s credit traders, ranked No. 1 for the second consecutive year in The Asset’s Best Individuals in Asian G3 bonds in 2022. In the same survey, Nicholas Yap, Asia head of flow credit desk analysts, ranked No. 2 among analysts.

“Across asset classes, we score very high versus our competition on our intellectual capital and the complex structured solutions we are able to deliver to our clients on a regular basis,” said Mr. Teshima.

Recognition has followed not far behind. Nomura won GlobalCapital’s Interest Rates Derivatives House of the Year – Europe and Asia for the second year in a row in 2022.

Investment Banking Agility

The focus for investment banking in Asia ex-Japan continues to be on the core markets of China, India and Australia, while taking advantage of opportunities in Southeast Asia, South Korea and Taiwan.

Within sectors, the team in Asia works alongside other regions to offer a comprehensive strategy across Greentech industrials and infrastructure (GII); technology, media and telecom; financial sponsors; and consumer and retail. Nomura formed GII in early 2022 to boost its global ESG and infrastructure offerings.

“We support clients where we have a right to win, and where individual country opportunities offer sufficient scale,” said Mr. Teshima. “We are not trying to be all things to all people. Rather, we are a client-centric and solutions-oriented fi rm, always positioned to move decisively and with focus.”

In debt capital markets, Nomura was at the forefront of the re-awakening of the primary Australian dollar bond market toward the end of 2022 as it helped execute several public market green and social bonds, and its first blue bond. These helped Nomura close out 2022 as the top kangaroo bonds adviser globally.

The firm also has well-recognized equity capital markets capabilities in the region, having advised Thai Life Insurance raise over $1 billion in a Thai initial public offering in a volatile market in July. In India, it remains among the top foreign banks advising on domestic IPOs, a position it has reserved for itself over the past few years.

Wealth Management Buildout

From September 2020, Nomura has embarked on a significant expansion of its international wealth management business, which is now aligned under its wholesale (global markets and investment banking) division. Since then, it has successfully opened its 1,000th client account, bringing in record cumulative net new money of over $5.5 billion. This has been made possible by critical platform upgrades and product suite enhancements.

The business has also made a number of hires, with about 90 private bankers now covering the key target markets of Greater China, Southeast Asia, the Middle East and the NRI segment.

Towards the end of last year, the wealth management business received approval to set up a branch in Dubai through which it can market to clients in the Middle East.

“Managing the wealth of high-net-worth clients internationally has been one of the latest forays we have been able to make successfully. The business aims to differentiate itself by delivering institutional-level solutions to high net-worth clients,” said Mr. Teshima.

China Expansion

While last year marked Nomura’s 40th anniversary in China, it has been a beneficiary of recent government policy and market reforms, establishing its majority-owned securities joint venture, Nomura Orient International Securities, three years ago.

Today, it employs 230 people in Shanghai, Beijing, Shenzhen and Zhejiang, and has more than 2,000 client accounts.

“In these three years, we’ve laid the foundations to build our domestic capabilities. But the value that Nomura can bring to doing business in China is to add our global capabilities,” said Mr. Teshima, who is also the leading deputy head of Nomura’s China committee.

Private Market Capabilities

Private markets and helping clients with customized solutions is another emerging area that Nomura has identifi ed globally for growth.

Over the past year, Bizongo in India and Wadiz in South Korea are younger companies Nomura has advised for private fund-raising. It also invested in Singapore-based Alta, formerly known as Fundnel, a digital marketplace for alternative investments.

Asian debt markets too have continued to evolve rapidly, accelerated by the extreme market volatility witnessed this past year. The market environment is shifting the debt market opportunity set toward private market and bespoke solutions, which is a trend that Nomura believes will remain signifi cant for the foreseeable future.

“This trend plays well into our DNA of originating, structuring and distributing innovative debt solutions to clients,” said Mr. Teshima.

Digital Transformation

Staying at the forefront of digital-led innovation is a key business priority for Nomura.

It aims to offer innovative and best-in-class products and advisory services to build a digitally enabled and trusted ecosystem that will reshape the financial industry.

“We will continue to invest to scale up and accelerate our digital transformation. Our focus will be on areas such as big data and AI, cybersecurity, blockchain and digital assets,” said Mr. Teshima.

Last year, Nomura announced the creation of a new wholly-owned digital asset company to provide institutional clients and investors with products and services linked to cryptocurrencies, stable coins, decentralized fi nance, non-fungible tokens and other tokens.

As the firm expands into newer businesses, a key consideration is to “ensure we have the appropriate governance and control frameworks to support our business strategies,” said Mr. Teshima.

“Everyone has a role to play in contributing to a strong risk culture, which is essential to the sustainability of Nomura’s success, built with clients at the center of everything we do.”