Southeast Asian ride-hailing and food delivery giant Grab hopes to accelerate growth on the heels of its first profitable full year that ended in December, planning to boost sales and profits while investing aggressively in advanced technologies including autonomous driving.

Grab last week announced new three-year targets through 2028. It will aim to increase revenue by 70% from the fiscal year ended December and triple its key profit metric, adjusted EBITDA (earnings before interest, tax, depreciation and amortization), to $1.5 billion.

The Singapore-headquartered company is at an “inflection point where this business now can compound both the top line and bottom line at the same time,” Grab CFO Peter Oey told Nikkei.

Grab’s services operate across eight Southeast Asian countries, including Singapore, Malaysia, Thailand and Indonesia, and it is working to further solidify its position in the region.

Roughly one in five of Southeast Asia’s 700 million people uses Grab at least once a year. This significantly outpaces rival GoTo in markets such as Indonesia.

Grab expanded its share of the Southeast Asia food delivery market to 55% in 2025, a 1.2 percentage point increase from the year before, according to Singaporean consultancy Momentum Works.

But it has not all been smooth sailing. Grab struggled to become profitable since its 2012 founding, even after listing on the U.S. stock market in 2021. When emerging U.S.-listed shares plummeted across the board in 2022, investors who had once been happy with revenue growth began to demand profitability.

That same year, Grab set out to overhaul its cost structure. This involved curbing promotional spending aimed at acquiring customers and cutting its workforce by around 1,000 people. It also boosted operational efficiency by using more artificial intelligence, automating over 90% of its ride-hailing dispatch operations.

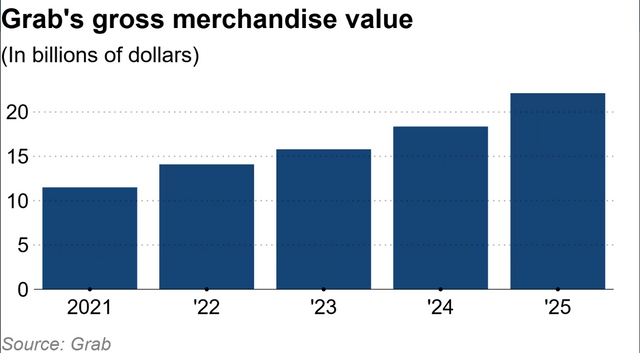

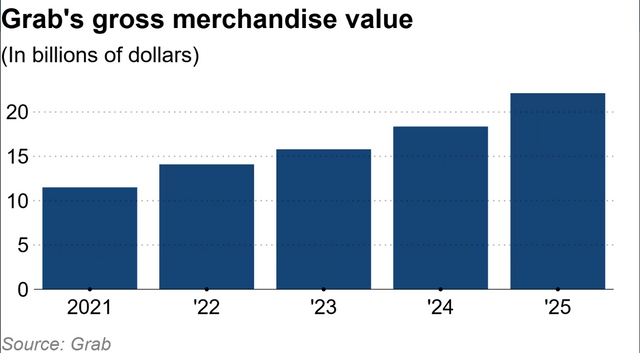

The reforms paid off, and the company’s adjusted EBITDA came into the black in 2024. Its gross merchandise volume, which had seen a dip due to less promotional spending, also rebounded. Grab went on to log its first full-year net profit in 2025.

To drive further growth, the company started by shoring up its existing business. Grab has added 400 cities over the past four years, but many untapped cities remain, Oey said, hinting at expansion plans.

Grab also plans to focus on raising order frequency for existing customers, as well as cross-selling to encourage users to try its other services, including ride-hailing, food delivery and financial services.

The company will also prioritize investing in startups with cutting-edge technology for business expansion and efficiency. In 2025, it invested in Chinese autonomous driving companies WeRide and Momenta, as well as Germany’s Vay Technology, a remote driving technology specialist. This month, it announced an investment in U.S. fintech company Stash Financial.

Grab leverages its Southeast Asia location — where it is less directly impacted by U.S.-China tensions — to invest in both Western and Chinese startups.

“This [geopolitically] agnostic approach allows us to leverage this unique position we are in with the ability to take the best technology from the world to adapt it to specific nuances of Southeast Asian [infrastructure],” said CEO Anthony Tan.

Meanwhile, observers have speculated for years about a possible merger between Grab and Indonesia-based GoTo. Many believe negotiations are being drawn out by regulatory approval and valuation processes.

While Oey said he could not offer further details, he characterized the three-year targets as rooted in “organic growth,” as opposed to growth through acquisitions. Any mergers would expand its business even further beyond that.

Grab’s stock price is showing signs of recovery, but it remains between $4 and $5, roughly one-third of what it was just after listing. Investors are looking for further growth.

The company’s “guidance leaves room for upside, given earlier [its] track record of delivering better than promised,” according to Sachin Mittal, an analyst at Singapore’s DBS Bank.